Table Of Contents 1Introduction2Route to market3Economic Moat4Past Performance5Hotel Chocolat’s biggest problems6Looking to the future7Fair Value Estimate (Discounted EPS) IntroductionHotel Chocolat PLC is a prominent British chocolatier and cocoa grower that…

Introduction

Hotel Chocolat PLC is a prominent British chocolatier and cocoa grower that has carved a niche with its focus on the premium chocolate market.

Combining cocoa growing and chocolate manufacturing, the company boasts a unique vertically integrated business model that sets it apart from competitors.

Hotel Chocolat currently operates almost exclusively in the UK following the recent failure of its USA and Japan ventures which management blames on the coronavirus pandemic.

Following these failures, shares have dropped to £1.40 a share at the time of writing, down over 50% in the past year.

This article will take a deep view of the company and its operations, highlighting both strengths and weaknesses, ultimately arguing that the shares are compelling at current levels based on the projected growth of UK operations alone.

Route to market

Hotel Chocolat PLC has a multi-channel approach to reach its customers, utilizing both physical stores and online platforms to maximize its market presence. See below a detailed description of Hotel Chocolat’s main routes to market.

Physical stores: Hotel Chocolat operates a network of 123 physical stores strategically located in various regions according to 2022 FY results. These stores serve as flagship locations, where customers can immerse themselves in the world of premium chocolate. The stores often incorporate cafés and the popular ‘wall of chocolate’ concept.

In-store cafés, in my opinion,offer a potential core driver of growth that deserves a bit more attention from management given the popularity of coffee chain stores in the UK.

Physical stores are Hotel Chocolat's main revenue driver, accounting for around 50% of sales.

Online presence: Hotel Chocolat has developed a robust online presence that allowed it to survive the COVID-19 pandemic. Their official website serves as an online storefront, enabling customers to browse and purchase their products from the comfort of their homes. Online sales currently account for around 35% of total revenue having dipped from pandemic-level highs.

Subscription-based model: Hotel Chocolat have also implemented a subscription-based model known as the "Tasting Club." Customers can join this club and receive a curated selection of chocolates on a regular basis, such as monthly or quarterly. This model not only generates recurring revenue but also fosters customer loyalty and engagement. These sales are reported under the 'digital' umbrella, contributing to online sales.

Wholesale and partnerships: In addition to direct-to-consumer sales, Hotel Chocolat has established wholesale relationships with selected retailers, such as John Lewis, allowing their products to reach a wider audience. They also collaborate with various partners to create co-branded or limited-edition products, expanding their market reach and appealing to different customer segments. Currently, Partners & B2B sales account for around 12% of total revenue.

The remaining 3% of revenue not noted above came from international sales in 2022 however, my analysis has assumed no international revenue moving forward despite management's current licencing approach to try once again to crack overseas markets.

Economic Moat

Readers will be aware that I usually only invest in companies with economic moats so will be surprised to learn that I do not consider Hotel Chocolat to have an economic moat.

An economic moat is like a protective barrier around a company's profits. It's a special advantage that makes it difficult for competitors to steal customers or take away market share. Imagine a castle with a deep, wide moat around it.

The moat represents things like brand loyalty, patents, unique technology, or a strong customer base. These advantages keep the company safe and give it a lasting competitive edge. Without a moat, a company is more vulnerable to competition and may struggle to maintain its profits over time. For this reason, I usually only invest in businesses with an economic moat.

In order to understand Hotel Chocolat's business model, it's important to understand that operations are not limited to chocolate manufacturing but also encompass cocoa growing.

In my opinion, this vertical integration (which covers the entire supply chain from cocoa bean to finished chocolate bar), serves as a potential genesis for a narrow but growing economic moat. Vertical integration provides Hotel Chocolat with greater control over the quality of product, availability of ethically sourced raw materials, and the overall production process, making it challenging for competitors to replicate their offerings and match the quality of product.

In addition, what makes Hotel Chocolat a potentially compelling investment in my eyes is that on top of owning and operating their own cocoa farm in Saint Lucia, they also maintain strong relationships with cocoa growers, encouraging ‘gentle farming’ practices which are ‘kind to nature and communities’. In return, Hotel Chocolat pay farmers a double-digit premium for their beans. These practices in turn ensure that Hotel Chocolat’s supply chain is free of deforestation, child labour and forced labour. Practices that are unfortunately all too prevalent in the coca bean industry.

See this report by the Food Empowerment Project for further details: https://foodispower.org/human-labor-slavery/slavery-chocolate/

More cynical readers may question what ethics has to do with economic moats.

Well, I argue that as well has having a positive ethical effect, the above practices are also a source of a potential economic moat as they align with the growing consumer demand for ethically sourced and sustainable products. As consumers become more conscious of the social and environmental impact of their purchasing decisions, they are often willing to pay a premium for products that support these values.

Ethical and sustainable sourcing is front and center in the consumer's mind when it comes to sustainability with a 2022 Deloitte survey noting that 56% of UK adults consider that goods being responsibly sourced and harvested make a product sustainable with 28% noting that this is a consideration when considering a purchase.

In a nut shell... I argue that competitors already at scale will find it incredibly difficult to match these ethical standards increasingly demanded by consumers in their already established supply chains often focused on cost.

Nevertheless, given the crowded premium-chocolate market and the presence of big-name players such as Lindt and other supermarket-placed brands, I would not be comfortable in assigning Hotel Chocolat an economic moat at this point.

I also do not underestimate the ability of the industry's big players to clean up their supply chains or to meaningfully compete for ethically minded consumers through lower volume subsidiaries or by way of acquisition.

However the seeds are there for a meaningful economic moat to be formed, only time will tell if these seeds blossom to present a meaningful competitive advantage.

Conclusion: No current moat, but possibly trending towards a Narrow Moat over the long term.

Past Performance

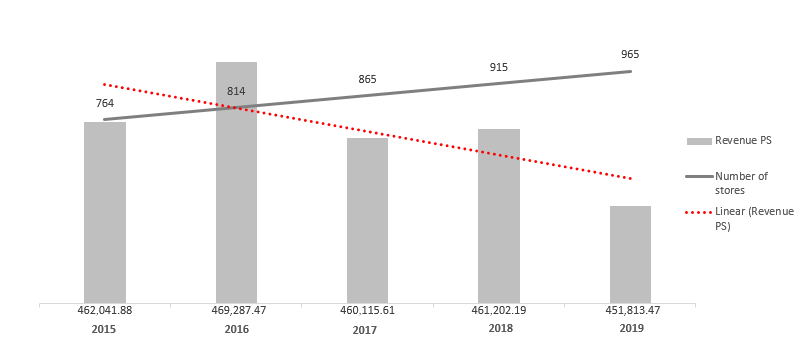

Hotel Chocolat has undoubtedly had a rough ride since the coronavirus pandemic for a variety of factors with the company recording net losses in 2020 & 2022.

See below revenue and net income after tax to 2022 and FY 2023 estimates based on the interim results. I have then provided my forecasts through to 2027 in grey.

Clearly these are disappointing results however I would argue that these results are not wholly reflective of the business' underlying fundamentals if we strip out the disaster that is international sales.

Although I can write off Covid and the joint ventures as simply one-off items, It wouldn't be fair to note that all the group's recent poor performance is down to one-off occurrences.

One thing that does worry me is the company's falling gross margin.

A declining gross margin is a red flag to any business-perspective investor as this is usually a sign of a lack of economic moat, a company's inability to pass on increased costs to consumers, a company's need to compete on price (a company I would never invest in after I learned the hard way following my investment in Card Factory)

Anyone working within the production/manufacturing space will know that wages have climbed substantially over the past 5 years and continue to climb. Indeed, this very fact is one of the core reasons UK inflation remains persistent where the USA have managed to get theirs under control.

A few days ago, the ONS released their most recent data on weekly earnings by industry and this trend sees no sign of abating. In the past 5 years, C1 wages (the category for Food, Beverage & tobacco manufacturing) increased from £517 p/w in April of 2018 to £636 p/w in April of 2023. A breathtaking increase of 23%.

Although I think that the bulk of the wage rises are now done with, I think we will continue to see moderate increases in manufacturing wages at this new normal. I have therefore assumed a continuation of the current 58% gross margin base in my modelled forecast.

Hotel Chocolat's biggest problems

Hotel Chocolat is widely recognized for its expertise in producing high-quality chocolates. It has established a strong reputation in the chocolate industry, which has contributed significantly to its success. However, recent developments indicating the company's expansion into non-chocolate products raise concerns about its strategic direction.

One possible justification provided by management for this diversification is the company's vision to become more of a 'cocoa' company rather than solely focusing on chocolate. While this argument may have some validity, it is essential to recognize that chocolate remains the primary revenue driver for Hotel Chocolat. Therefore, it would be prudent for the company to prioritize and emphasize its core chocolate offerings.

The introduction of alcoholic drinks and skincare products by Hotel Chocolat raises questions about the underlying motives behind this diversification. One worrisome explanation could be that the company has already saturated its core chocolate market and is seeking new avenues for growth. If this is indeed the case, it suggests that the company is struggling to sustain its growth trajectory solely through its chocolate products.

Moreover, the fact that Hotel Chocolat's co-founders, Angus Thirwell and Peter Harris, own a majority stake in the company raises another possibility. It is plausible to speculate that these non-chocolate products are a result of an overly ambitious leadership approach, characterized by a "perma-bull MD/CEO" mentality. This refers to a mindset where there is an excessive desire to conquer every market simultaneously, potentially overlooking the risks and challenges associated with such a strategy.

Should the hunch regarding an already saturated chocolate market prove to be accurate, Hotel Chocolat could face significant obstacles ahead. Competing in an overcrowded market would likely result in intensified competition, lower profit margins, and potential dilution of the brand's core identity. Therefore, it is crucial for the company to carefully evaluate the market dynamics and consumer demand before venturing into new product categories, ensuring they align with its core strengths and customer expectations.

Indeed, while diversification can be seen as a strategy to expand revenue streams, I would argue that it detracts from the company's core focus and dilutes its offering. Peter Lynch famously called this 'diworsification'. I'm reminded of Microsoft's lurch into the mobile phone hardware market here with their $7.6bn acquisition of Nokia.

When considering a company’s product offering, I like to take a snapshot of what I think their Marketing Bullseye looks like in order to sniff out potential lurches for revenue over quality earnings.

The Marketing/Product Bullseye is a way to visually represent different aspects or categories of products or offerings provided by a company. Each circle on the target board represents a specific category or group of products, with the most important or core products placed at the center of the bullseye.

The idea is that the closer a product is to the bullseye's center, the more central or vital it is to the company's core focus or brand identity. As you move outwards from the center, the products become less central but still relevant to the overall offering.

Here's where I landed when analysing Hotel Chocolat:

As I hope is evident here, the company's focus on anything outside of the primary and secondary circles is to me a miss-step - especially when you're trying to focus on growing these revenue streams alongside trying to crack the worlds largest and 3rd largest consumer markets at once (The USA & Japan).

Looking to the future

According to a 2020 survey by Mintel, 58% of UK chocolate buyers say ethical sourcing is important to them when purchasing chocolate products. Another study by GlobeScan found that in 2020, 51% of UK consumers actively sought out ethical and sustainable products, a significant increase from previous years.

The increasing demand for ethical and sustainable products, including chocolate, among UK consumers presents a significant opportunity for the company. With a growing emphasis on ethical sourcing and sustainability, Hotel Chocolat's commitment to these values can give them a distinct advantage in the market.

As more consumers prioritize ethical cocoa sourcing and actively seek out sustainable products, Hotel Chocolat's focus on supporting ethical supply chains positions them well to meet this demand. By aligning themselves with a brand that emphasizes ethical and sustainable practices, consumers can enjoy premium chocolates while contributing to a more ethical and sustainable chocolate industry.

In terms of investment proposition, the short-term challenges faced by Hotel Chocolat, such as the impact of Covid and failed overseas ventures, have potentially caused the market to undervalue the company's shares. However, it is worth noting that Covid is now over, and the management has learned from their overseas ventures and adopted a more cautious approach to future expansion.

With the joint ventures in Japan and the USA written off, Hotel Chocolat can focus on its UK growth journey, which historically accounted for the majority of its sales (with only 3-5% coming from the failed Japan USA ventures).

The shift towards a capex-light and low-risk licensing approach for overseas expansion further strengthens their position. While it's important to acknowledge that the growth story may take longer to unfold than initially anticipated, patient investors may still be rewarded in the long term

Fair Value Estimate (Discounted EPS)

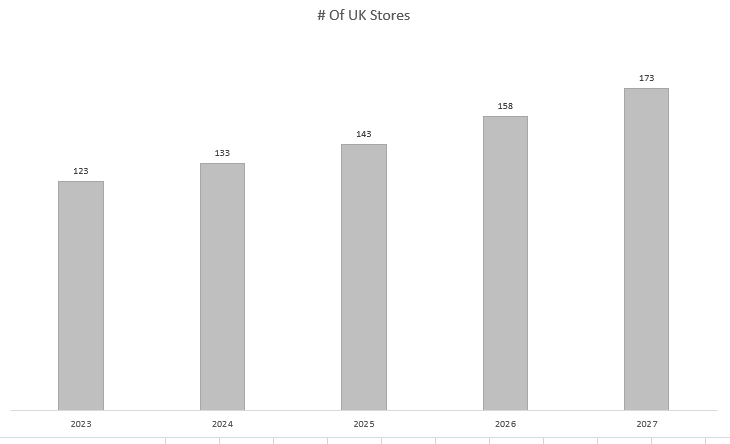

I took the 2023 store numbers of 123 and projected incremental growth to 173 by 2027, following management plans.

I assumed a conservative 10% growth rate for like-for-like sales over this period, considering the actual growth since 2020 is 25%, which is substantial even with post-COVID recovery taken into account.

I then calculated in-store income by multiplying the number of stores by the income by store.

Similarly, I estimated a 10% growth in non in-store sales between 2023-2027, which I believe is achievable based on more bullish estimates from analysts.

It's important to note that I assumed no international sales. If the international expansion miraculously succeeds this time around, it would significantly impact my model positively.

Assuming a 58% gross margin, I then adjusted selling, general, and administrative expenses to achieve a 19.8% EBITDA by 2027. This falls slightly below management's expectation of reaching 20% EBITDA over a shorter time period.

I assumed flat depreciation and amortization, considering the company's assurances that their new production facility will support production up to 450,000 pieces of chocolate, as shown in the final slide of their 2023 interim result. (Current output is 300,000 pieces, indicating that the 50% production headroom is more than sufficient to accommodate my estimates of 10% revenue growth

Therefore, I don't anticipate any significant capital expenditures that would drive depreciation above current levels.

Based on these assumptions, and assuming a 15% tax rate (roughly accounting for R&D relief capital allowances and relief on losses), I have arrived at my net income results for my model.

It's worth noting that utilizing my method, my 2023 net income assumption results in £6.1m, which falls within the range of management expectations of £4-7m.

To reach my EPS assumptions, I assumed a share-count increase of 1% compounded across each year, resulting in a 4.1% growth in basic shares. I am optimistic that this growth rate will be lower, considering that major capital expenditures related to the new warehouse are complete.

I then utilized a discounted EPS model to determine the fair value of the shares, assuming a 10% risk-free rate and a 2% terminal growth rate after 2027. However, I am optimistic that the growth rate will be higher than 2% beyond 2027.

Based on my calculations, the fair value of the shares is determined to be £1.79 per share. This value is 22% higher than today's share price of £1.40 per share.

Therefore, this indicates that the shares may be undervalued.

Frugal Student Verdict: BUY as a higher-risk potential turn-around play.

After all, the prospect of a miracle turnaround by Co-founder Julian Dunkerton (pictured left) is an attractive one. Superdry isn’t a brand that’s going to disappear anytime soon, even if it is as old and tired as I suspect.

After all, the prospect of a miracle turnaround by Co-founder Julian Dunkerton (pictured left) is an attractive one. Superdry isn’t a brand that’s going to disappear anytime soon, even if it is as old and tired as I suspect.